LEGACY CONTENT.

If you are looking for Voteview.com, PLEASE CLICK HEREThis site is an archived version of Voteview.com archived from University of Georgia on

May 23, 2017. This point-in-time capture includes all files publicly linked on Voteview.com at that time. We provide access to this content as a service to ensure that past users of Voteview.com have access to historical files. This content will remain online until at least

January 1st, 2018. UCLA provides no warranty or guarantee of access to these files.

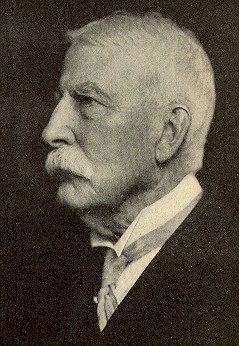

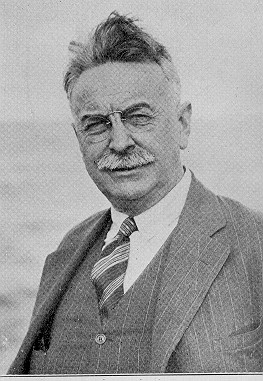

John D. Rockefeller

born: 8 July 1839

died: 23 May 1937

Entrepreneurs and American

Economic Growth

JOHN D. ROCKEFELLER

Sources for the Lecture:

Chernow, Ron (1998). Titan:

The Life of John D. Rockefeller, Sr.. New York: Random House.

Flynn, John T. (1932). God’s

Gold: The Story of Rockefeller and his Times. New York: Harcourt, Brace and

Company.

Folsom, Burton W. Jr.

(1991). The Myth of the Robber Barons: A New Look at the Rise of Big

Business in America. Herndon, Virginia: Young America’s Foundation.

Nevins, Allan

(1940). John D. Rockefeller: The Heroic Age of American Enterprise. New

York: Charles Scribner’s Sons.

- Youth

- Born 8 July 1839

in Richford, New York about midway between Binghamton and Ithaca. His

father, William Avery Rockefeller, was a "pitch man" -- a

"Doctor" who claimed he could cure cancers and charged up to

$25 a treatment. He was gone for months at a time traveling around the

West from town to town and would return to wherever the family was living

with substantial sums of cash. His mother, Eliza Davison Rockefeller, was

very religious and very disciplined. She taught John D. to work, to save,

and to give to charities.

- By the age of 12 he

had saved over $50 from working for neighbors and raising some turkeys

for his mother. At the urging of his mother, he loaned a local farmer $50

at 7% interest payable in one year. When the farmer paid him back with

interest the next year Rockefeller was impressed and said of it in 1904:

"The impression was gaining ground with me that it was a good thing

to let the money be my servant and not make myself a slave to the

money…"

- From 1852 Rockefeller

attends Owego Academy in Owego, New York where the family had moved in

1851. Rockefeller excelled at mental arithmetic and was able to

solve difficult arithmetic problems in his head – a talent that would be

very useful to him throughout his business career. In other subjects

Rockefeller was an average student but the quality of the education was

very high.

- In 1853 the

Rockefellers move to Cleveland, Ohio and John D. attends high school from

1853-55. He was very good at math and was on the debating team. The

school encouraged public speaking and even though Rockefeller was only

average, it was a skill that would prove to useful to him and that

he did not use enough!

- Early Business Career:

1855-1863

- In the spring of 1855

Rockefeller spent 10 weeks at Folsom’s Commercial College – a "chain

College" – where he learned single and double-entry bookkeeping,

penmanship, commercial history, mercantile customs, banking and exchange.

From his father he had learned how to draw up notes and other business

papers. His father was very meticulous in matters of business and

believed in the sacredness of contracts.

- In August of 1855 at

the age of 16 Rockefeller begins looking for work in Cleveland as a

bookkeeper or clerk. Business was bad in Cleveland at the time and

Rockefeller had problems finding a job. He was always neatly dressed in a

dark suit and black tie. Cleveland was not a large city in 1855 and

Rockefeller could easily visit every business in under a week’s time. He

returned to many businesses three times. Finally, on 26 September 1855,

he got a job as an assistant bookkeeper with Hewitt & Tuttle,

commission merchants and produce shippers.

- Rockefeller soon

impressed his employers with his seriousness and diligence. He was very

exacting and scrupulously honest. For example, he would not write out a

false bill of lading under any circumstances. {Bill of Lading –

a written receipt for goods accepted for transportation, given by a

shipping company to the consignor. A written receipt that goes back to

the shipper.} He went to great lengths to collect overdue accounts.

He was pleasant, persistent, and patient and he got the company’s money

from the delinquents. (For all this work, he was not well paid. But

whatever he was paid, he always gave to his Church and local charities.)

- By 1858 Rockefeller

has more responsibilities at Hewitt & Tuttle. He arranged complicated

transportation deals that typically involved moving a single shipment of

freight by railroad, canal, and lake boats. He began to engage in trading

ventures on his own account. He was naturally cautious and only undertook

a business venture when he calculated that it would be successful. After

he carefully weighed a course of action he would then act quickly and

boldly to see it through to fruition. He had iron nerves and would carry

through very complicated deals without hesitation. This combination of

caution, precision, and resolve soon brought him attention and respect in

the broader business community in Cleveland.

- On 18 March 1859

– several months before his 20th birthday -- Rockefeller goes

into business for himself forming a partnership with a neighbor, Maurice

Clark. Each man put up $2000 and formed Clark & Rockefeller –

commission merchants in grain, hay, meats, and miscellaneous goods. At

the end of the first year of business, they had grossed $450,000 making a

profit of $4400 in 1860 and a profit of $17,000 in 1861. The commission

merchant business was very competitive and Clark & Rockefeller’s

success was due in large part to Rockefeller’s natural business

abilities.

- During the Civil War

their business expanded rapidly. Grain prices went up and so did their

commissions. Most of their selling was done on commission so Clark &

Rockefeller took no risks from price fluctuations. Rockefeller’s style

was very precise and calculated. He was not a gambler but a planner. He

avoided speculation and refused to make advances or loans. (That is,

advancing a customer money on produce before they received the produce

and wrote up a bill of lading.)

- Rockefeller was

extremely hard working. He traveled extensively drumming up business

throughout Ohio and then would go to the banks and borrow large sums of

money to handle the shipments. This aggressive style built the business

up every year.

- However, by the early

1860s Rockefeller realized that the future of the commission merchant

business in Cleveland was going to be limited. He had become convinced

that the railroads were going to become the primary means of

transportation for agricultural commodities. This would be to the

disadvantage of Cleveland because its position as an important Lake port

was its primary transportation advantage. He saw that the rising grain

output of the Midwest and the Northwest of J. J. Hill would change the

nature of the business for good. The huge elevators on Lake Michigan and

the flour-millers of Minneapolis would be the dominant players in the

business. Rockefeller came to believe that the future of Cleveland lay in

the collection and shipment of raw industrial materials -- not

agricultural commodities. This would allow Cleveland to exploit its

geographical advantages – mid-way between the Eastern seaboard and

Chicago – and access to both rail and water transportation. He saw his

chance in 1863 – oil.

- Summary: The

early phase of Rockefeller’s career shows the key qualities that were to

make him so spectacularly successful later on: 1) hard working; 2) very

competitive; 3) a "Chess-Player" who embodied a rare

combination of qualities – caution, precision with imagination, and

resolve -- the courage to see a plan through to completion regardless

of the cost; 4) a skilled business strategist and forecaster.

- Oil Refining 1863-65

- On 27 August 1859

Edwin Drake struck oil near Titusville, Pennsylvania setting off a frenzied

oil boom in what soon became known as the "oil regions" of

northwestern Pennsylvania. Drake was the employee of a group of New

Haven, CT investors in the PA Rock Oil Company. They had obtained a

sample of the PA oil and had a Yale University chemist analyze it and the

chemist determined that the PA oil was of very high quality and could be

refined into a variety of useful products.

- The technology used

by Drake was not new. What was new was the idea of drilling for oil

– the idea that you could pump oil out of the ground like you

could pump water.

- The technology for

drilling wells was quite advanced by 1859. To that time wells were

drilled for either water or salt (more accurately, brine which would be

refined to get the salt). In the process of drilling for salt all over

the United States in the early 19th Century it was not

uncommon – especially in the Pennsylvania area – to get oil seepage into

the salt well. Most of the time this was regarded as a nuisance but some

enterprising merchants went into the business of selling the oil in small

bottles as a "Natural Remedy" or "Curative Agent".

- The technology for

refining oil was also known by the early 1850s. Doctor Abraham Gesner, a

Canadian, in August 1846 patented a method for distilling kerosene (a

name he invented from the Greek keros – wax – and elaion –

oil – wax-oil!) from coal. In 1850 a Scottish industrial chemist,

James Young, patented a method of obtaining "burning oils" from

petroleum through destructive distillation. In 1852 two Boston chemists,

Luther and William Atwood began making lubricants from coal tar. Finally,

in 1856, Samuel Downer, a whale-oil merchant, buys out the Atwoods and

boosts production to 650,000 gallons of refined oil a year. By 1861

coal-oil lamps were wide-spread and coal-oil was even made in Cleveland.

- Rockefeller began

investigating the feasibility of entering the oil refining business in

1862 and the firm of Andrews, Clark & Company was formed in

1863. (Samuel Andrews had experience with shale-oil refining and Clark

brought in his brothers.) Probably figuring in Rockefeller’s decision to

enter the business was the entry into Cleveland later that year of the

long-planned Atlantic & Great Western Railroad. The A&GW

line went east to Meadville, PA, then northeast to Corry, Pa and then

across the border into New York state where it connected to the Erie

Railroad. The A&GW also had branches into the heart of the oil

regions – Titusville and Franklin. This gave Cleveland two routes to New

York City – the New York Central-Lake Shore system, and the A&GW-Erie

connection. This immediately gave Cleveland a transportation advantage

over Pittsburgh which was dominated by the Pennsylvania Railroad.

- The PA oil was of

high quality. One barrel yielded 60-65% illuminating oil, 10% gasoline, 5-10%

benzoyl or naphtha (volatile inflammable liquid used as a solvent in dry

cleaning, varnish making, etc.), with the remainder tar and wastes.

- Rockefeller abhorred

waste and devoted considerable energy on increasing the efficiency of his

refining business. He believed that the secret of success was attention

to detail – to wringing little efficiencies out of every aspect of his

business. He hired his own plumber and bought his own plumbing supplies.

He built his own cooperage shop and made his own barrels for the oil. He

bought tracts of white-oak timber for making the barrels. Instead of

transporting the freshly cut green timber directly to the cooperage shop,

he had kilns built on the timber tracts to dry the wood on site to reduce

the shipping weight of the lumber. He bought his own wagons and horses to

transport the wood to the cooperage shop in Cleveland. {Aside – We

would call this" vertical integration" today!}

- Oil Refining 1865-1870

- In February, 1865 at

the age of 24, Rockefeller buys out the Clark brothers (Maurice Clark

had brought his brothers into the refining business) for $72,500 and

gains complete control of the business. The Clarks had resisted borrowing

money to expand and Rockefeller was convinced of the correctness of his

course (as usual), so he bought them out. He immediately moved to greatly

expand the business. He borrowed heavily and plowed all his profits back

into the business in order to expand it further and took decisive steps

to strengthen and increase the efficiency of all aspects of the firm.

- In 1866 John D.

brings his brother William Rockefeller into the partnership and they

build another refinery in Cleveland named the Standard Works. They

also open a New York City office with William Rockefeller in charge to handle

the export business which eventually became larger than the domestic

business.

|

|

|

Henry M. Flagler

- In 1867 Henry M.

Flagler (2 January 1830 to 20 May 1913) becomes a Partner and Rockefeller,

Andrews & Flagler is formed. {Aside – Flagler left school at

age 14. Not wanting to burden his poor family any further, he walked to

the Erie canal 1n 1844 and took it to the Lake and then went to Ohio via

a Lake Steamer. Flagler and Rockefeller had met years earlier in

Bellevue, Ohio, when Rockefeller was buying grain for his commission

house and Flagler was a grain merchant. Flagler had gone into the salt

well business but went broke in 1865. He began to recoup his fortune in

1865 in Cleveland as a manufacturer of Oil Barrels and had an office in

the same building as Rockefeller. Flagler and Rockefeller were very much

alike – ambitious, taste for expansion, and their shrewdness.

They became very good friends and had a symbiotic business

relationship.} Flager’s wife’s uncle, Stephen V. Harkness,

becomes a silent partner and makes substantial investments in the

Partnership. (Harkness never took an active part of running the

business.) These investments by Harkness and Flagler are used to expand

the business even further.

|

- By 1868 Rockefeller,

Andrews & Flagler were the largest refiners in the world. Flagler

and Rockefeller understood that the only way to make profits consistently

in oil refining was to make the business as large as possible and to

utilize all their "waste" products. The refining process during

this early period was very primitive – refining consisted simply of

cooking the oil and purifying it somewhat. The physical plant was simple

some large vats, stills, the piping, and a few chemicals. A small

refinery could be set up with just $10,000 and a large one with $50,000.

In modern language, the barriers to entry were very, very low! It

would be like setting up a small business in today’s business climate.

- Consequently, if the

price of kerosene was high, even the small and inefficient refiners could

make good money. So, even when the price of kerosene fell sharply driving

some refiners out of business, the entry costs were so low that when

times were good many small operators could enter the business cheaply

making it a very competitive market.

- It was the logic

of this competitive structure that determined the course of action of

Rockefeller and Flagler.

- They built high-quality,

larger, and better-planned refineries. They built permanent facilities

using the best materials available.

- They owned their

own cooperage (barrel making) plant, their own white-oak timber and

drying facilities, and bought their own hoop iron. Consequently, they

cut the cost of a barrel from about $3.00 to less than $1.50.

- They manufactured

their own sulfuric acid (which was used in the purification process) and

devised technology to recover it for re-use.

- They owned their

own drayage service consisting of at least 20 wagons in 1868.

- They owned their

own warehouses in New York City and their own boats on the Hudson and

East Rivers to transport their oil.

- They were the first

to ship oil via tank cars (albeit big wooden tubs mounted in pairs on

flat cars – later to evolve into the modern form of a tank car). And

they owned their own fleet of tank cars.

- They built huge

holding tanks near their refineries for storing crude and refined oil

with the equipment for drawing off the oil from the tank cars into the

holding tanks.

- Their huge size

made it economical to build the necessary physical plant to handle all

the "waste" products from the refining of kerosene. They began

manufacturing of high quality lubricating oil that quickly

replaced lard oil as a lubricant for machinery. Gasoline, which

many refiners surreptitiously dumped into the Cuyahoga River at night

(which often caught fire), Rockefeller and Flagler used as fuel. They

manufactured Benzine (used a cleaning fluid; a solvent for fat,

gums, and resin; and used to make varnish), paraffin (insoluble

in water, used for making candles, waterproofing paper, preservative

coatings, etc.), and Petrolatum (used as a basis for ointments

and as a protective dressing; as a local application in inflammation of

mucous membrane; as an intestinal lubricant, etc. – white petrolatum later

marketed under the brand name Vaseline). They shipped Naphtha

(volatile inflammable liquid used as a solvent in dry cleaning and in

wax preparations, varnish and paint making, burning fluid for

illumination, and as a fuel for motors) to gas plants and other users.

- In short, nothing

was left to chance, nothing was guessed at, nothing left uncounted and

measured, efficiencies down to the smallest detail of the business were

the order of the day. Economy, precision, and foresight were the

cornerstones of their success.

- The sheer size of

the business by and the fact that Cleveland was served by two

railroad systems – the New York Central (via the Lake Shore), and the

Erie (via the Atlantic & Great Western – which Jay Gould bought in

1868) – and had access to the Lake for water-borne shipping, gave

Rockefeller and Flagler tremendous leverage with the railroads.

Consequently, Flagler was able to negotiate big rebates from the

railroads. The combination of size, efficiency, and the rebates gave

Rockefeller and Flagler an advantage over other refiners that they would

never relinquish.

- The railroad

situation benefited not only Rockefeller and Flagler, the other Cleveland

refiners also benefited at the expense of the refiners of Pittsburgh.

Pittsburgh was a prisoner to the Pennsylvania Railroad that had a

monopoly position in that city and it wanted to ship everything to

Philadelphia because it meant more money for the railroad. Consequently,

Cleveland refiners had a built-in advantage over Pittsburgh. In this

regard, the railroads – the Erie and New York Central – were not "victims"

of the "crooked" refiners, rather, the railroads looked

upon the refiners as associates and co-workers! They had a

commonality of interests!

- Summary: By

1870 Rockefeller is 31 years old and his business style is well

established: 1) hard working; 2) very competitive; 3) a

"Chess-Player" who embodied a rare combination of qualities – caution,

precision with imagination, and resolve -- the courage to see a plan

through to completion regardless of the cost; 4) a skilled business

strategist and forecaster; 5) the ability to pick gifted associates and

work with them harmoniously.

- The Standard Oil: 1870-1882

- On 10 January

1870 the Standard Oil Company of Ohio was created by John D.

Rockefeller (30%), William Rockefeller (13.34%), Henry Flagler (16.67%),

Samuel Andrews (16.67%), Stephen Harkness (13.34%), and O. B. Jennings

(brother-in-law of William Rockefeller, 10%). It held about 10% of the

oil business at the time of its formation.

- In Rockefeller’s

eyes, the state of the oil business was chaotic. Because entry costs were

so low in both oil drilling and oil refining, the market was glutted with

crude oil with an accompanying high level of waste. In his view, the

theory of free competition did not work well when there was a mix of very

large, efficient firms, and many medium and small firms. His view was

that the weak firms in their attempts to survive drove prices down below

production costs hurting even the well managed firms such as his own.

- Although his

economics may be suspect in modern eyes, his solution – a market with a

few (maybe one!) large, vertically integrated firms -- in effect an

oligopolistic market – was what other industrial sectors eventually

evolved into. What makes oil stand out is that it happened by design –

as the result of a plan formulated by a single person – John D.

Rockefeller!

- During 1871

Rockefeller formulated his plan for consolidating all oil refining firms

into one great organization with the aim of eliminating excess capacity

and price-cutting. Although no written records exist, both Rockefeller

and Flagler 30 years later claimed this was when they worked out the master

plan which they later implemented. That the plan was formulated in 1871

is evidenced by the fact that all the major Cleveland banks joined the

Standard Oil organization in 1871 and later backed Rockefeller and

Flagler to the hilt in their rapid expansion.

- The South

Improvement Scheme

- What interrupted

Rockefeller and Flagler’s careful planning was the emergence of the

South Improvement Scheme of 1871. Tom Scott of the Pennsylvania Railroad

came up with the idea. The scheme was inspired by the Anthracite Railroad

combination of 1868-71 in which five railroads and two coal companies

bought up all the coal pits along the five railroads in order to control

output and prices.

- The South

Improvement Company had been created by the Pennsylvania Legislature in

1870 and its charter allowed the Company to hold the stocks of other

companies outside the state. This was an unusual power at the time and

made it ideal for Scott’s scheme. Scott arranged for the purchase of the

charter by a group of Philadelphia and Pittsburgh refiners with Scott in

the background.

- The Scheme was

essentially a plan to unite the oil-carrying railroads in a pool; to

unite the refiners in an association, the South Improvement Company; and

to tie the two elements together by agreements which would stop

"destructive" price-cutting and restore railroad freight

charges to a profitable level.

- To enforce the

cooperation of refiners, a set of rebates was agreed to for

participating refiners. This alone would have undoubtedly forced all the

refiners into the combine, but the scheme did not stop there. In what

turned out to be a public relations disaster, the participants decided

to add a drawback on every barrel shipped by a non-participant

equal to the ordinary rebate! In effect, this would be a tax on non-participants

the proceeds of which would be transferred to the participating oil

refiners!

- What the planners

forgot, however, was to include the producers in the scheme as

well. Despite efforts to reassure the drillers in the Oil Regions that

the Scheme would benefit them as well by keeping prices up, the Oil

Regions Men revolted and organized an effective boycott of all the

refiners and railroads they suspected of being part of the Scheme.

Consequently, the Scheme collapsed in 1872 before it was ever implemented!

- Subsequent

historians repeated the view of many at the time that Rockefeller had

been one of the originators of the South Improvement Scheme. In fact he

had not been but he and Flagler did agree to participate and worked hard

to set up the Scheme. Rockefeller’s most important error of his career

was to not go public at the time with his side of the story. This was

the first time that a broad public became aware of Rockefeller and the

episode was to forever tarnish his reputation. He said of it later

"Our silence encouraged the wildest romancers to spread wild tales

about us"; and on another occasion, "I shall never cease to

regret that at that time we never called in the reporters."

- In December 1871,

during the dust-up over the South Improvement Scheme, Rockefeller and

Flagler set in motion their plan to consolidate the industry. They begin

by buying up all their competitors in Cleveland. The strategy and tactics

were Rockefeller’s and he handled the negotiations with the rival

refiners personally. He began with the strongest refineries first. He

believed that if he had bought up the weak refineries first then he would

be faced with higher prices later and stiffer resistance. Consequently,

he approached the strongest first and bought them out.

- His technique was

always the same. The merger would be effected by an increase in the

capitalization of The Standard Oil. The rival refinery would be appraised

and the owners would be given Standard Oil stock in proportion to the

value of their property and good will and they would be made

partners in Standard Oil. The more talented owners would also be brought

into the Standard Oil management. If they insisted upon cash they

received it.

- Later some owners

who had been bought out complained to the press that they had been

treated unfairly. The evidence is overwhelming that the Standard’s rivals

were paid fair – even generous – prices for their property and if they

had the wisdom to take Standard Oil stock, they ended up very rich

indeed.

- By March-April 1872

Rockefeller had bought up and/or merged with almost all the refineries in

Cleveland. The inefficient and poorly constructed refineries were

dismantled while the better quality ones were upgraded to Rockefeller and

Flagler’s standards.

- After the conquest

of Cleveland, the Standard inexorably expanded. All the transactions were

kept as secret as possible! The leaders of the Standard were so

successful in this secrecy at times that many rival independent refiners

were totally unaware of what was going on.

- 1872: Jabez

A. Bostwick brought into the Standard along with his important oil

facilities on Long Island and on New York Harbor.

- 1873: Devoe

Manufacturing Company (Long Island); Chess, Carley and its important

distribution system in the Kentucky region (Louisville, KY).

- 1874:

Standard begins building its own pipeline system using Bostwick &

Co. {Aside: The teamsters fought pipelines tooth and nail but were

destined to lose because it was so much cheaper and easier for the

producers to send their crude through pipes as opposed to wagons. It was

a short logical step to extend those pipelines directly to refineries.}

Rockefeller makes a deal with the Erie Railroad and gains control of

important terminal facilities in New York harbor in exchange for

shipping half of Standard’s oil on the Erie. The Standard expands into

the Oil Regions gaining control of the Imperial Refinery near Oil City

and bringing J.J. Vandergrift into the Standard management. Two large

refineries in Titusville join the Standard and John Archbold {later

the President of Standard Oil} is brought into the management. The

Standard expands into Pittsburgh by merging Warden, Frew & Co. and

Lockhart, Frew & Co thereby acquiring half the refining capacity of

Pittsburgh. The Standard expands into Philadelphia by buying the largest

refinery.

- 1875: The

Standard buys more pipelines and firms in the oil buying business and

merges them all into the United Pipe Lines in 1877. Flagler and

Rockefeller negotiate an agreement with the railroads: PA RR 51% of Standard

Oil shipments; Erie 20%; NYC 20%; and B&O 9%, and obtains rebates

from all the railroads for being an "evener" (that is, the

Standard was charged with making certain that the railroads all got

their "fair" share!).

- 1875-76: Johnson

N. Camden (later Senator from WV) comes into the Standard secretly and

moves to buy up all the WV oil supply to squeeze the Pittsburgh

independents. By 1876 Camden gains control of most of the WV refineries.

- 1877:

Standard buys the Columbia Conduit Co. of PA and gains control of its

pipelines and refineries. The Columbia Conduit Co. had tried to bypass

the PARR by building a pipeline from the Oil Regions down to the new

B&O railroad line near Pittsburgh. The PARR used armed guards to

prevent them from laying a pipeline under its right-of-way north of

Pittsburgh! The Standard gains control of most of the property of the

Empire Transportation Company – a subsidiary of the PARR that had its

own fleet of tank cars, pipelines, lake steamers, and terminals in New

York harbor. The Empire had briefly threatened the Standard but

Rockefeller built 600 new tank cars, cut prices, and cancelled all his

shipments over the PARR. The PARR capitulated and sold Rockefeller the

Empire's assets.

- 1877-78: The

Standard and the trunk lines agree on a new split: PA 47%; NYC 21%; Erie

21%; B&O 11%. New York City was to get 63% of the total traffic and

Baltimore and Philadelphia 37%. On refined oil, non-Standard

companies shipping from Cleveland, Pittsburgh, and Titusville paid

$1.44.5 per barrel while the Standard paid $.80!

- 1878: The

Standard forces the railroads to pay a drawback of 20-35 cents a

barrel of crude oil shipped by any other party! In effect,

this was a tax levied by The Standard upon its competitors. This

combination of rebates and "taxes" (some authors dub this a

"drawback" – but that term is also used to refer to a specific

type of rebate) is what forced the remaining independent refiners to

capitulate to the Standard. Production increases in oil regions because

of large discovery in Bradford area. Standard is forced to frantically

build as many large holding tanks as possible to hold the market glut of

oil.

- By 1879 The Standard

Oil did about 90 percent of the refining in the United States with almost

70 percent being exported overseas. The business had become so large and

so complex that Rockefeller only dealt with the major problems and the

larger outlines of his affairs. Rockefeller was only 40 years old.

- The Standard’s only

serious competitor – the Tidewater Pipe-Line Company (later the Tidewater

Oil Company) – emerges in 1879-83. It takes Rockefeller by surprise and

succeeds in building a pipeline from the Oil Regions east across northern

Pennsylvania to Williamsport where the oil was transferred to the Reading

railroad. The Reading then took the oil down to a refinery at Chester,

Pennsylvania on the Delaware Bay. Rockefeller tries to gain control of

Tidewater but fails and it has about 10% of the market in 1888.

- The Standard Oil Trust:

1882-1892

- On 2 January 1882

the Standard Oil Trust was formed. Attorney Samuel Dodd came up with the

idea of a Trust. A Board of Trustees was set up and all the Standard

properties were placed in its hands. Every stockholder received 20 Trust

certificates for each share of Standard Oil stock and all the profits of

the component companies were sent to the nine trustees who determined the

dividends. The nine Trustees elected the directors and officers of all

the component companies.

- The Trust was

capitalized quite conservatively at $70,000,000 – the true value was

about $200,000,000 (no stock watering at the Standard!). The nine

Trustees controlled 23,314 of the 35,000 shares with J.D. Rockefeller

holding 9585 shares.

- Rockefeller, at age

43, was the leader of the Trust because he was primus inter pares (pry-mus

inter pay-reez – first among his peers) not a dictator. As such, he could

not dictate policy even when he felt strongly that he was right. An

example of this was the Lima Oil field in Ohio. The field had been

discovered in the early 1880s. The problem was that the oil was

"sour" – that is, it had a very high sulfur content so it

smelled like rotten eggs. Even worse, when it was refined into kerosene

and used in lamps it produced too much soot which coated the lamp

chimneys. Rockefeller wanted to buy up as much of the oil as possible and

worry about solving the sulfur problem later. The other directors were

unenthusiastic about this policy and Archbold (the future President of

Standard Oil!) even began quietly selling some of his Trust shares in the

Standard. By 1888 the Standard owned 40,000,000 barrels of the Lima oil

which were stored in huge tank farms at the fields. Rockefeller hired a

great chemist, Herman Frasch, who, with the aid of very talented Standard

engineers, devised a process that utilized copper oxides to remove the

sulfur from the oil. The result was a bonanza for the Standard

vindicating Rockefeller’s judgement.

- By 1890 The Standard

had set up an elaborate nationwide distribution system that reached

nearly every American town. By 1904 80% of American towns were served by

Standard Oil carts that delivered the various products directly to

businesses and homes. Standard Oil’s campaign to dominate even the smallest

of the retail markets is probably the single most important reason that

the Standard became so disliked by the American public. The Standard was

very aggressive in its marketing practices and tried to force all grocery

and hardware stores that sold kerosene and lubricants to sell only

Standard products. This policy – though successful in the short run –

made the Standard widely unpopular and simply increased its vulnerability

to political attack.

- On 21 March 1892

the Trust was formally dissolved. The Attorney General of Ohio had

brought suit against the Trust in 1890 and it lost in 1892. Each trust

certificate was to be exchanged for the proportioned share of stock in

the 20 component companies of the Standard. The irony is that this had no

practical effect on the Combination. The same men were still in charge

only now they were simply the majority shareholders of all the component

companies!

- Rockefeller Exits:

1892-1897

- During 1891-92 all

the evidence suggests that Rockefeller had a partial nervous breakdown

from overwork. He lost all of his hair including his eyebrows and

suffered from ill health for a number of years in the early 1890s.

- During this period

Rockefeller’s wealth had increased to such an extent that his major

problem was what to do with it all. He solved this problem by hiring Frederick

T. Gates in September of 1891 as a full time manager of his fortune.

By this time Rockefeller was literally inundated with appeals from

individuals and charities for funds. Gates not only removed this burden

he also oversaw all of Rockefeller’s investments which were becoming huge

in their own right. For example, by 1897 Rockefeller owned large holdings

of the Missabe iron range in Minnesota, a railroad to carry the ore to

Lake Superior, and a fleet of huge ore carrying lake steamers. In 1901

Rockefeller sells his iron ore related business to J.P. Morgan for

$80,000,000 with an estimated profit of at least $50,000,000 – a huge fortune

in its own right but it was just one of his investments! Morgan added the

Rockefeller properties to the U.S. Steel Corporation.

- By 1896 Rockefeller

stopped going to his office daily and in 1897 he retired at the age of

58. He took part in some management activity until 1899 but none to speak

of thereafter. John Archbold actually ran Standard Oil from the mid-1890s

onward. Archbold disliked prominence and asked Rockefeller to remain as

the nominal President of Standard. Not publicly announcing his retirement

was a great mistake on Rockefeller’s part. Rockefeller had resisted the

temptation to exploit the Standard’s near monopoly position by raising

prices "too" much. Although Rockefeller’s pricing policies did

result in some "Monopoly profits" for the Standard they were

fairly mild. Not so Archbold. He raised prices aggressively and the

dividends rolled in. The consequence was that Rockefeller got all the

blame for the policies even though he had almost no further role in

management.

- Retirement and Philanthropy

- From the mid 1890s

until his death in 1937 Rockefeller’s activities were all philanthropic.

Rockefeller’s fortune peaked in 1912 at almost $900,000,000 but by that

time he had already given away hundreds of millions of dollars. His son, John

D. Rockefeller Jr., in 1897 joined Gates in the full time management of

the fortune.

- The University of

Chicago – which Rockefeller is largely responsible for creating -- alone

received $75,000,000 by 1932.

- He set up, at the

urging of his son, the Rockefeller Institute for medical research (now

Rockefeller University) and his gifts to it total $50,000,000 by the

1930s.

- He founded the

General Education Board in 1903 (later the Rockefeller foundation). The

General Education Board helped to establish High Schools throughout the

South by providing free professional advice on improving instruction and

education. The effort was a cooperative one (so it would not be seen as

condescending by Southern politicians) and local money was used to build

the High Schools. In 1919 Rockefeller donated $50,000,000 to the Board to

raise academic salaries which were very low in the wake of WWI.

- The Rockefeller

Foundation is officially established in 1913 and Rockefeller transfers

$235,000,000 to it by 1929.

- In 1909 Rockefeller established

the Rockefeller Sanitary Commission which was largely responsible for

eradicating the hookworm in the South by 1927.

- When Rockefeller

died on 23 May 1937, his estate totaled only $26,410,837. He had

given most of his property to his philanthropies and to his son and other

heirs.

- Summary of Business

Style: 1) hard working; 2) very competitive; 3) a

"Chess-Player" who embodied a rare combination of qualities – caution,

precision with imagination, and resolve -- the courage to see a plan

through to completion regardless of the cost; 4) a skilled business

strategist and forecaster; 5) the ability to pick gifted associates and

work with them harmoniously.

- Was Rockefeller a

Schumpeteran entrepreneur? Yes. He clearly changed "the stream of the

allocation of resources over time by introducing new departures into the

flow of economic life" by creating the modern oil

industry. His emphasis on size and efficiency and the use of

modern chemistry resulted in the development of a wide variety of new

products that made the lives of ordinary people better as a consequence. He

made light cheap for untold millions and his great creation was

ready, willing, and able to provide the cheap gasoline when it was

needed thus ushering in the age of the automobile in America.

|

|

|

Doctor Charles Wardell Stiles, a Leader in the Fight to Eradicate the Hookworm

Last, but not least, he set

the standard for philanthropy. Just the eradication of hookworm in the South

alone would merit his place as one of the great humanitarians of the 20th

Century. But his reputation was so sullied that he never received the credit

that he was due for this great act on behalf of humankind.

|

VOTEVIEW Blog

VOTEVIEW Blog

NOMINATE Data, Roll Call Data, and Software

NOMINATE Data, Roll Call Data, and Software

Course Web Pages: University of Georgia (2010 - )

Course Web Pages: University of Georgia (2010 - )

Course Web Pages: UC San Diego (2004 - 2010)

Course Web Pages: UC San Diego (2004 - 2010)

University of San Diego Law School (2005)

University of San Diego Law School (2005)

Course Web Pages: University of Houston (2000 - 2005)

Course Web Pages: University of Houston (2000 - 2005)

Course Web Pages: Carnegie-Mellon University (1997 - 2000)

Course Web Pages: Carnegie-Mellon University (1997 - 2000)

Analyzing Spatial Models of Choice and Judgment with R

Analyzing Spatial Models of Choice and Judgment with R

Spatial Models of Parliamentary Voting

Spatial Models of Parliamentary Voting

Recent Working Papers

Recent Working Papers

Analyses of Recent Politics

Analyses of Recent Politics

About This Website

About This Website

K7MOA Log Books: 1960 - 2017

K7MOA Log Books: 1960 - 2017

Bio of Keith T. Poole

Bio of Keith T. Poole

Related Links

Related Links