Cornelius Vanderbilt

born: 27 May 1794

died: 4 January 1877

|

Cornelius Vanderbiltborn: 27 May 1794 died: 4 January 1877 |

Entrepreneurs and American Economic Growth

Cornelius (Commodore) Vanderbilt

|

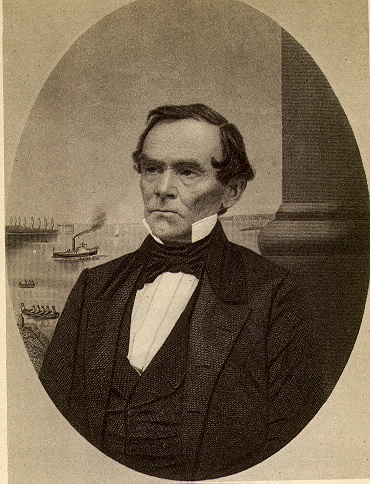

Daniel Drew

|

During the summer months the New York Central would transfer all lot of its freight to steamboats for the trip to New York City rather than shipping the freight over the Hudson. However, Vanderbilt began buying NYC stock in 1863-64 and was able to influence the election of Erastus Corning as President in 1864. From 1864-66 Vanderbilt and the New York Central cooperated. In December 1866 interests hostile to Vanderbilt gained control of the NYC and the cooperative relationship ended. On 14 January 1867 Vanderbilt retaliated by announcing that the terminus of the Hudson River RR would henceforth be East Albany. East bound freight piled up in Albany because the river was frozen over. East bound Passengers had to walk across the ice to catch the train down to New York.

The NYC quickly capitulated because it was under great competitive pressure from the other Trunk Line Railroads -- especially the Erie and the Pennsylvania.

During the summer months the New York Central would transfer all lot of its freight to steamboats for the trip to New York City rather than shipping the freight over the Hudson. However, Vanderbilt began buying NYC stock in 1863-64 and was able to influence the election of Erastus Corning as President in 1864. From 1864-66 Vanderbilt and the New York Central cooperated. In December 1866 interests hostile to Vanderbilt gained control of the NYC and the cooperative relationship ended. On 14 January 1867 Vanderbilt retaliated by announcing that the terminus of the Hudson River RR would henceforth be East Albany. East bound freight piled up in Albany because the river was frozen over. East bound Passengers had to walk across the ice to catch the train down to New York.

The NYC quickly capitulated because it was under great competitive pressure from the other Trunk Line Railroads -- especially the Erie and the Pennsylvania.